What Is An Off Balance Sheet Activity

Off-Balance Sheet OBS Also known as Off-Balance sheet items Off-Balance sheet assets or liabilities and Incognito Leverage. The standards bring into broad alignment the accounting treatment for off balance sheet activities in International Financial Reporting Standards IFRSs.

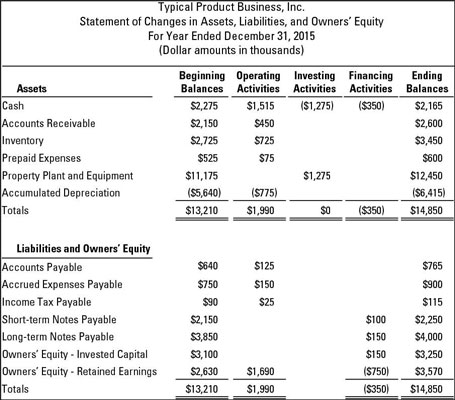

Changes In Balance Sheet Accounts Dummies

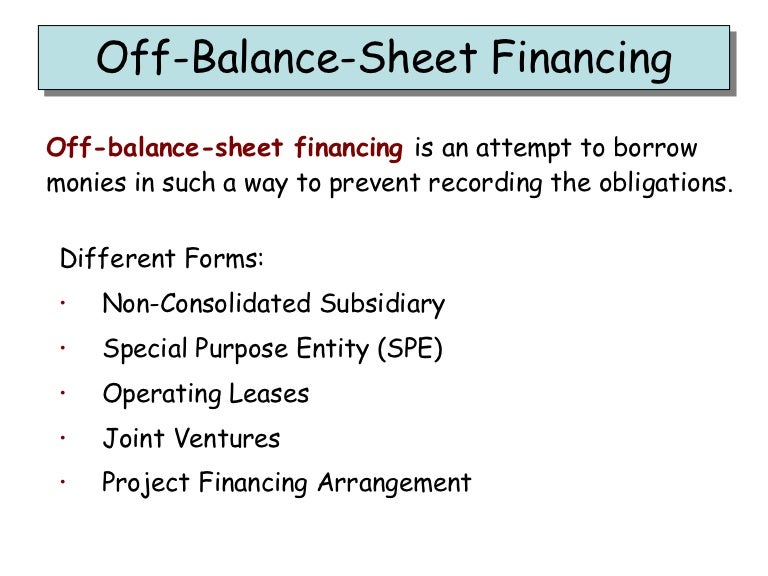

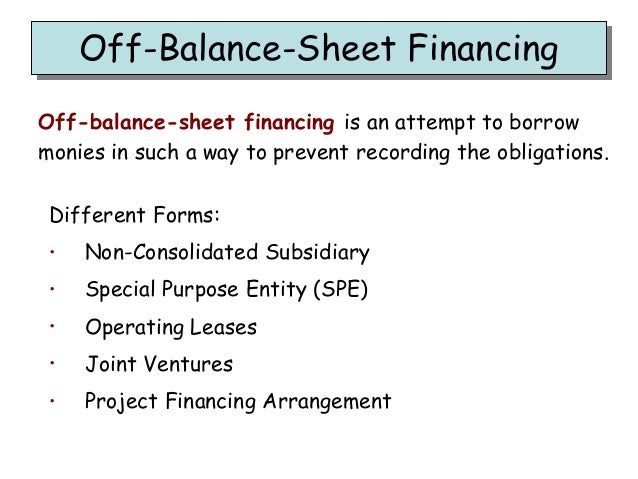

Off balance sheet financing allows an entity to borrow being without affecting calculations of measures of indebtedness such as debt to equity DE and leverage ratios low.

What is an off balance sheet activity. They are either a liability or an asset which are not shown on a companys balance sheet as the business is not a legal owner of the respective item. These activities create assets or liabilities that are not reflected on the balance sheet of a firm as they are contingent in nature. An item is classified as an off-balance-sheet asset when the occurrence of the contingent event results in the creation of an on-balance-sheet asset.

Off balance sheet refers to the assets debts or financing activities that are not presented on the balance sheet of an entity. Off balance sheet refers to the assets debts or financing activities that are not presented on the balance sheet of an entity. Off-balance-sheet financing refers to types of transactions and methods of accounting for transactions in which no liabilities are recorded to an organizations financial statements.

Off balance sheet financing allows an entity to borrow being without affecting calculations of measures of indebtedness such as debt to equity DE and leverage ratios low. While not recorded on the balance sheet itself these items are. Off-balance-sheet activities are conducted by banks to earn additional income apart from lending and deposit activities.

It includes items like letter of credit leaseback agreements etc. The financial obligations that result from OBSF are known as off-balance-sheet liabilities. In many cases off-balance-sheet liabilities are simply recorded as.

Off-balance sheet activities include items such as loan commitments letters of credit and revolving underwriting facilities. The use of off-balance sheet may improve activities earnings ratios because earnings generated from the. Off balance sheet refers to those assets and liabilities not appearing on an entitys balance sheet but which nonetheless effectively belong to the enterprise.

An off-balance sheet activity does not appear on the financial intuitions balance sheet rather it is shown as a note bellow the balance sheet. Institutionsare required to report off-balance sheet items in conformance with Call Report Instructions. Now off-balance sheet activities can affect the future shape of the financial institutions balance sheet thus can be a significant source of risk exposure.

Financial innovation involves more than development and diversification of new borrowing sources. When investors study the financial statements of a company they give close attention to the liquidity of the company one measure of which is the ratio of debt to equity. These items are usually associated with the sharing of risk or they are financing transactions.

The International Accounting Standards Board IASB has recently issued three standards. Off-balance sheet OBS items are an accounting practice whereby a company does not include a liability on its balance sheet. Up to 10 cash back Abstract During the past couple of decades financial institutions have sharply expanded their off-balance sheet activities.

The issuance of these standards completes IASBs improvements to the accounting requirements for off balance sheet activities and joint arrangements. Off balance sheet events are comprised of financial transactions that are not captured or disclosed anywhere on a companys balance sheet but may be. This trend has been fostered by the stepped-up pace of financial innovation.

Similarly an item is an off-balance-sheet liability when the contingent event creates an on-balance-sheet liability. By using off-balance sheet financing a company might find it easier to obtain funding through equity capital or loans. Off-balance-sheet activities or items are contingent claim contracts.

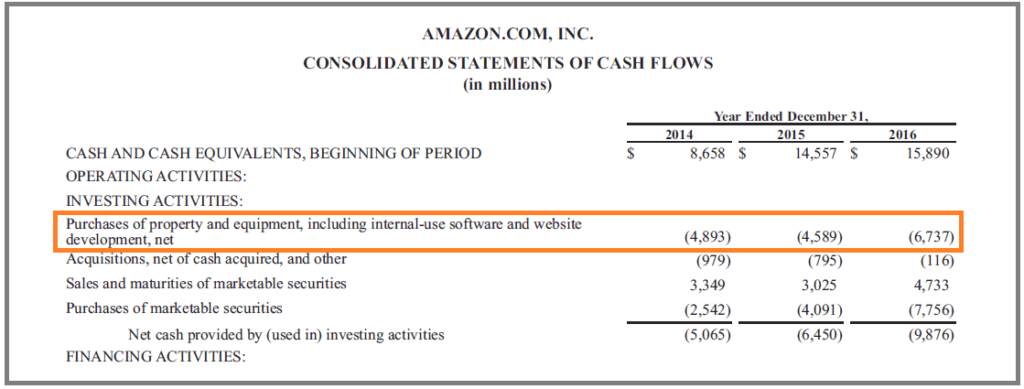

Capital Expenditure Capex Guide Examples Of Capital Investment

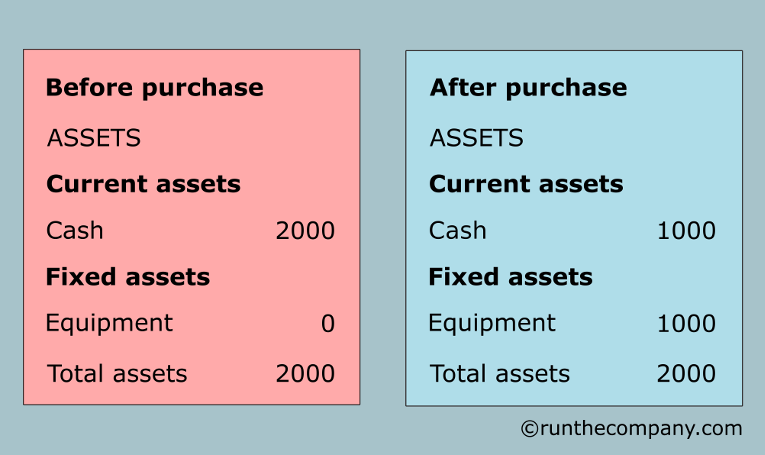

Balance Sheet Examples Runthecompany

Bookkeeping Balance Sheet And Income Statement Are Linked Accountingcoach

Balance Sheet Examples Runthecompany

The Balance Sheet Boundless Finance

Balance Sheet Examples Runthecompany

Disposal Of Assets Disposal Of Assets Accountingcoach

Balance Sheet Examples Runthecompany

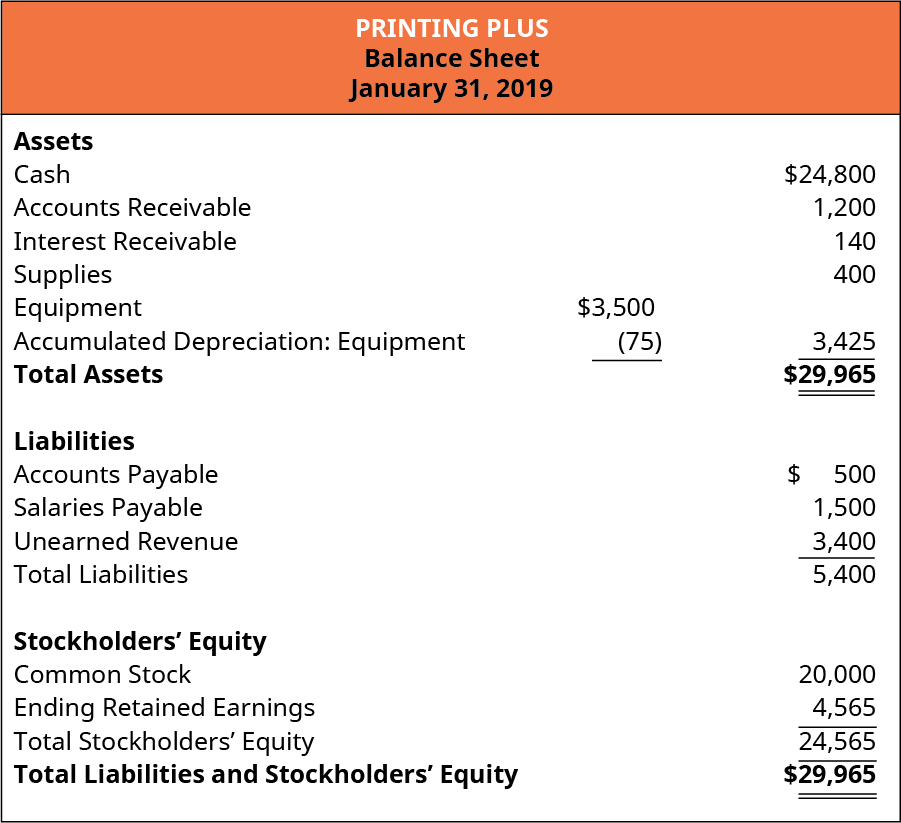

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

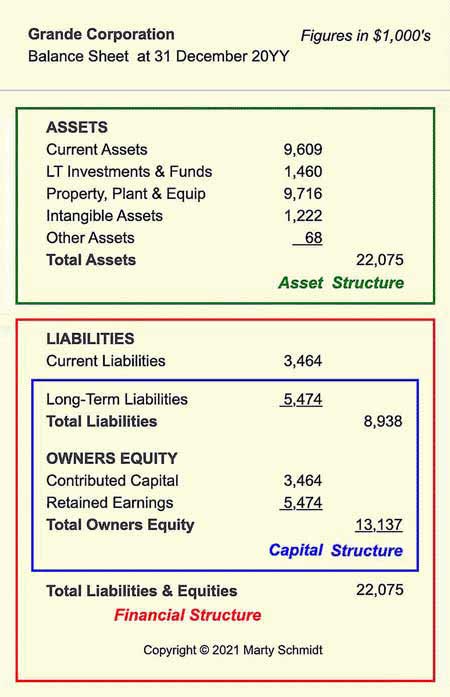

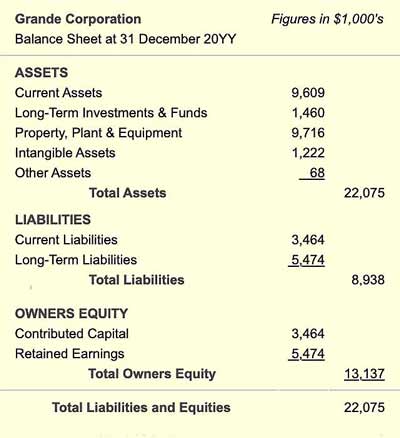

How Balance Sheet Structure Content Reveal Financial Position

Balance Sheet Liabilities Current Liabilities Accountingcoach

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

Cash Flow Statement Analyzing Cash Flow From Investing Activities

Bookkeeping Balance Sheet And Income Statement Are Linked Accountingcoach

How Balance Sheet Structure Content Reveal Financial Position

:max_bytes(150000):strip_icc()/GettyImages-172940273-28a7232c2a9149a9a191440b7b8a397c.jpg)

6.jpg)